- QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME HOW TO

- QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME MANUAL

- QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME PRO

- QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME SOFTWARE

- QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME PLUS

QuickBooks Quick Trick to Reconcile Payroll Bank Account new The key to entering your payroll correctly is to understand the difference between gross and net payroll. Users can use QuickBooks Payroll Reports to report taxes that user contribute as an employer and the Payroll taxes withheld from employee wages. Select the new filing and deposit schedule, and select an effective date. Your tax history will be entered once you click Enter. Select the form you need to file from the list.

Select the Effective date Which is used for calculation amount on the 940 and 941 form. To create a file in QuickBooks Desktop to upload to your state: Select Employees, then Payroll Tax Forms and W-2s, and select Create State SUI E-file. You will see the create form option and open the file form. QuickBooks offers a myriad of business products and services, but is arguably best known for its accounting software: Intuit QuickBooks. However, you can make the process a little less painful by using QuickBooks Desktop to calculate and even file and pay your payroll taxes. Select the date range, then choose the name of the tax payment.

QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME HOW TO

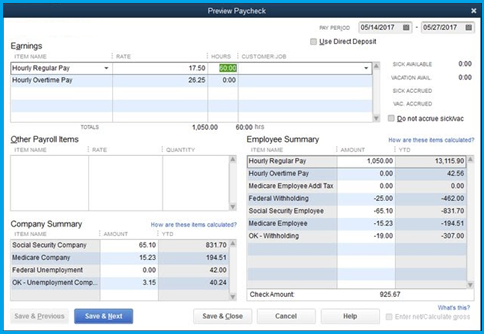

DESKTOP PAYROLL Getting Started Guide Check out our guide How To Do Payroll In the Pay section, select Edit. Set up a payroll item for retirement benefits (401 (K), Simple IRA, etc.) Users Payroll Reports can help lenders and government agencies analyze the business's Payroll costs. Here's how to set up Quickbooks Online Standard: Go to Employees > Payroll, and under Let's get your business ready for payday, select Let's go. For example, the Payroll Center has existed in QuickBooks for several years now. In the Pay Taxes & Pay a scheduled liability in QuickBooks Desktop Go to the Employees menu, then select Payroll Center. The user must then pick the Payroll bank account and then input the date range that includes the pay date which he is going to print.

QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME SOFTWARE

At the bottom of the screen under Other Activities, click Manage Payment Methods Click Schedule Payments QuickBooks Payroll T-sheets is an employee time tracking software that will make payroll even simpler and accurate time tracking easy.

subscription, you can purchase and activate Desktop Payroll by going to the QuickBooks Home page and clicking Turn On Payroll. Step 4 - Help opens the topic window, read the information thoroughly, including. In the Payroll section, select Payroll Tax and Wage Summary. How To Pay Payroll Taxes In Quickbooks Online - XpCourse Live Follow the steps below to file and pay your payroll taxes in QuickBooks Online: From your QuickBooks Online homepage, go to Taxes at left menu bar.

QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME PRO

QuickBooks Pro 2019 Desktop payrollGo to the Employees menu at the top, then choose Payroll Center.Under the Create Paychecks table, select the Payroll tab.Choose the pay period you want to update.Click the drop-down arrow beside Payroll Schedules and choose Edit Schedule.Update the necessary fields and click OK. Click the View tax payments you have made under Taxes. Set up pay and withholding items common to all employees on this screen. Step 1 - Click Help on the QuickBooks bar, the select QuickBooks Help. Click on the topic Calculating payroll taxes manually (without a subscription to QuickBooks Payroll).

QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME MANUAL

Step 2 - Search for the manual setup article by typing calculate payroll manually. For Items GP1-GP10, setup common pay categories (regular pay). Change your tax payment methods in QuickBooks To set up supported payroll taxes as scheduled payments for e-pay: 1. With QuickBooks Payroll Desktop, you can generate as many paychecks for your employees as you need and all you need to do is just enter the hours. Once you've added your employees and payroll items, you'll need to set up your federal and state payroll taxes. Choose Open to import the report file into QuickBooks. Quickbooks Payroll Taxes Tutorial XpCourse. QuickBooks Desktop Payroll makes your important payroll activities.

QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME PLUS

QuickBooks Pro Plus desktop 2020 to pay payroll taxes and get ready because we bookkeeping pros are moving up the hilltop with QuickBooks Pro Plus desktop 2022. Gross payroll is the total amount you pay your employees before deductions. This can be a significant time saver, especially when the month to month reporting is not needed. On the left panel, select Payroll & Employees then go to the Company Preferences tab.

0 kommentar(er)

0 kommentar(er)